Conversion in progress ...

Please wait while we generate your PDF

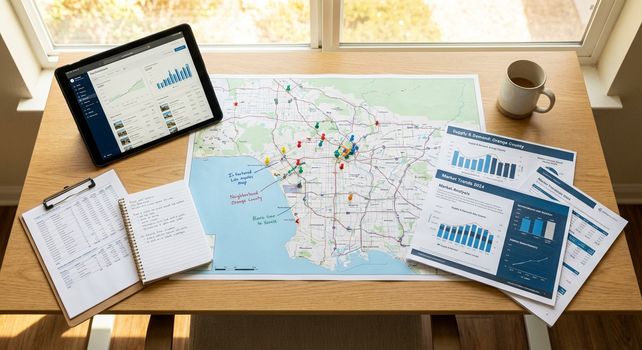

Market Snapshot Evergreen (How This Market Works)

QUICK SUMMARY

What you'll learn in 5 minutes:

- The fundamental forces that drive all real estate markets (supply, demand, and pricing)

- Why some homes sell in days while others sit for months (it's not random)

- How seasonal patterns affect inventory and buyer behavior year after year

- What actually causes prices to rise or fall (beyond what the news tells you)

- How to read market signals so you know when conditions favor buyers vs. sellers

- A framework for making smart decisions regardless of current market conditions

- How Orange County's unique characteristics influence local market dynamics

You Don't Need to Predict the Market—You Need to Understand How It Works

Turn on the news and you'll hear conflicting messages: "Now is the best time to buy!" "Wait for prices to drop!" "Inventory is tight!" "The market is shifting!"

It's overwhelming. And most of it is noise.

Here's what we've learned after nearly 30 years helping families buy and sell in Cypress and Orange County: The fundamentals of how real estate markets work never change. Once you understand these principles, you can make smart decisions in any market condition.

This guide isn't about predicting what will happen next month or next year. It's about understanding the timeless forces that drive all real estate markets—so you can evaluate your options clearly whether the market is hot, cold, or somewhere in between.

This is for you if:

- You're confused by conflicting market information and want to understand what's actually happening

- You want to know why some homes sell instantly while others sit

- You need to understand whether current conditions favor buyers or sellers

- You're trying to decide whether to move forward now or wait

- You want to make decisions based on understanding, not fear or FOMO

START HERE (30 SECONDS)

Find your situation below and jump to the section that matters most:

- "I don't understand why homes are priced the way they are" → Jump to "What Actually Drives Pricing"

- "I want to know if it's a good time to buy or sell" → Go to "Reading Market Signals: Buyer vs. Seller Markets"

- "I'm wondering if I should wait for a better season" → Read "How Seasonality Affects Your Timing"

- "I want to understand why some homes sell fast and others don't" → Start with "Why Homes Sit vs. Sell Fast"

- "I want to understand the full market picture" → Read straight through

What Most People Get Wrong About Real Estate Markets

Here's the pattern we see repeatedly:

Someone decides to buy or sell. They ask friends and family for advice. They read headlines about the national housing market. They see a story about prices in another city. They hear conflicting opinions from everyone they talk to.

They get overwhelmed by information that doesn't actually apply to their specific situation and freeze—either waiting indefinitely for "perfect" conditions that never come, or making emotional decisions based on fear or pressure.

The mistake: Treating real estate markets like they're unpredictable, mysterious forces beyond understanding.

The reality: Real estate markets operate on consistent, understandable principles. Once you know how to read the signals, you can make informed decisions with confidence.

The Three Forces That Drive Every Real Estate Market

Every real estate market—regardless of location, time period, or external conditions—is driven by three fundamental forces:

Force #1: Supply (How Many Homes Are Available)

Supply = the number of homes for sale at any given time

High supply:

- Lots of homes available

- Buyers have many options

- Sellers must compete for buyers

- Longer time on market

- More negotiating power for buyers

Low supply:

- Few homes available

- Buyers have limited choices

- Homes sell faster

- Multiple offers more common

- More negotiating power for sellers

What affects supply:

- Homeowners' willingness to sell (are they confident moving makes sense?)

- New construction (are builders adding inventory?)

- Economic conditions (do people need to sell or can they wait?)

- Life events (job changes, family changes, retirement, etc.)

- Seasonality (more sellers list in spring/summer)

Orange County specific factor: Limited land availability means new construction can't expand supply dramatically like it can in sprawling suburban markets. This creates inherent supply constraints that support pricing over time.

Force #2: Demand (How Many Buyers Are Looking)

Demand = the number of qualified, motivated buyers actively searching

High demand:

- Many buyers competing

- Homes sell quickly

- Multiple offers common

- Upward pressure on prices

- Sellers have advantage

Low demand:

- Fewer active buyers

- Homes take longer to sell

- Single offers, less competition

- Downward pressure on prices

- Buyers have advantage

What affects demand:

- Financing conditions (how easy/affordable is it to get a mortgage?)

- Economic confidence (do people feel secure in their jobs and finances?)

- Population growth (are people moving to the area?)

- Lifestyle factors (do people want to live here?)

- Seasonality (more buyers search in spring/summer)

Orange County specific factors:

- Strong job market and diverse economy create consistent demand

- Desirable lifestyle (weather, beaches, amenities) attracts buyers from other regions

- Quality schools drive family buyer demand

- Limited alternatives—buyers who want to live in Orange County have few substitutes

Force #3: Price (The Balance Point Between Supply and Demand)

Price is determined by where supply and demand intersect.

When demand exceeds supply:

- Prices rise

- Sellers have pricing power

- Buyers must compete

- "Seller's market"

When supply exceeds demand:

- Prices stabilize or fall

- Buyers have negotiating power

- Sellers must compete

- "Buyer's market"

When supply and demand are balanced:

- Prices remain relatively stable

- Neither buyers nor sellers have overwhelming advantage

- "Balanced market"

The key insight: Prices aren't set by sellers' desires or buyers' wishes. They're set by the interaction between available inventory and active buyer demand.

Why Homes Sit vs. Sell Fast

This is one of the most misunderstood dynamics in real estate. People assume it's random or just about "the market." It's not.

The Fast Sale Formula

Homes sell quickly when they hit the sweet spot of:

1. Correct Pricing

- Priced at or slightly below current market value

- Aligned with recent comparable sales

- Positioned within the right price band for search filters

2. Strong Presentation

- Professional photography

- Clean, decluttered, well-staged

- Move-in ready condition

- Excellent curb appeal

3. Maximum Exposure

- Listed during high-activity season (spring/summer)

- Properly marketed across all platforms

- Easy showing access

- Active buyer pool in that price range

4. Motivated Seller

- Realistic expectations

- Flexible on terms

- Responsive to feedback

- Willing to negotiate reasonably

When all four factors align: homes sell in days, often with multiple offers, frequently above asking price.

Why Homes Sit on the Market

Homes linger when one or more factors are off:

Pricing Problems (Most Common):

- Priced above comparable sales

- Seller testing the market with inflated price

- Not adjusting when initial price doesn't generate activity

- Priced just above a search filter threshold (e.g., $650k instead of $649k)

Presentation Problems:

- Poor photography or no professional photos

- Cluttered, dirty, or poorly maintained

- Deferred maintenance visible

- Cosmetic issues that signal "work required"

Marketing/Access Problems:

- Difficult showing times

- Requires excessive notice

- Poor marketing exposure

- Listed during slow season with no pricing adjustment

Seller Mindset Problems:

- Unrealistic expectations

- Emotionally attached to pricing

- Inflexible on terms or negotiations

- Not motivated enough to price competitively

The pattern: Homes don't sit because "the market is slow." They sit because they're not positioned correctly for current market conditions.

The Days on Market Signal

Days on market (DOM) is one of the clearest indicators of pricing accuracy:

0-7 days: Priced aggressively, generating immediate interest

- Likely to receive multiple offers

- May sell above asking

- High buyer demand for this property at this price

8-21 days: Priced competitively within market range

- Generating adequate showing activity

- Likely to receive solid offers

- Normal absorption rate for the market

22-45 days: Priced at top of range or slightly above

- Showings but fewer offers

- May need minor price adjustment

- Buyers comparing to other options

46-90 days: Overpriced for current conditions

- Showings declining

- Price reduction likely needed

- Property becoming "stale"

90+ days: Significantly overpriced or major issues

- Minimal showing activity

- Substantial price reduction needed

- Buyers assume something is wrong

The insight: Days on market tells you whether the seller correctly read the market or is chasing it downward.

What Actually Drives Pricing

People have a lot of misconceptions about what determines home prices. Let's clarify.

What DOES Affect Home Prices

Recent Comparable Sales:

- The #1 factor in pricing

- What similar homes sold for in the last 90 days

- Arms-length transactions (not family sales, foreclosures, or distress sales)

- Same neighborhood or very close proximity

Current Competition:

- What else is available right now in the same price range

- Your home doesn't sell in a vacuum—it competes with active listings

- If comparable homes are available for less, yours won't sell at a premium

Property Condition and Features:

- Updated vs. original condition

- Functional layout vs. awkward floor plan

- Desirable features (garage, yard, view, etc.)

- Location within neighborhood (corner lot, cul-de-sac, premium position)

Supply and Demand Dynamics:

- How many buyers are actively searching in your price range

- How much inventory is available

- Absorption rate (how long it takes to sell available inventory)

Broader Economic Conditions:

- Employment levels and wage growth

- Financing availability and costs

- Consumer confidence

- Population trends

Location Fundamentals:

- School quality and boundaries

- Proximity to employment, shopping, amenities

- Neighborhood character and reputation

- Transportation access

What DOESN'T Affect Home Prices (But People Think It Does)

What you paid for it:

- The market doesn't care what you paid

- You're not entitled to appreciation

- Your cost basis is irrelevant to buyers

What you need to net:

- Your financial needs don't determine market value

- Buyers won't pay more just because you need the money

How much you've invested in improvements:

- You don't get dollar-for-dollar return on improvements

- Over-improving for the neighborhood doesn't create value

- Personal taste improvements may not appeal to buyers

What Zillow/Redfin estimate says:

- Algorithms don't know your home's specific condition

- They lag behind market shifts

- They can't account for unique features or problems

What your neighbor's house is listed for:

- Listing price and selling price are different things

- Overpriced listings aren't comparable data

- Only closed sales determine value

What homes sold for 5-10 years ago:

- Historical prices are interesting but irrelevant to current value

- Markets change

- Only recent sales (90 days or less) matter for pricing

Your emotional attachment:

- Memories and meaning don't add market value

- Buyers evaluate properties objectively

- Your attachment actually clouds your pricing judgment

The bottom line: Pricing is determined by what buyers will pay based on current market data—not by sellers' wishes, past performance, or online estimates.

How Seasonality Affects Your Timing

Real estate markets have predictable seasonal patterns that repeat every year. Understanding these helps you time your move strategically.

Spring (March-May): Peak Activity Season

What happens:

- Inventory increases (sellers list to catch spring buyers)

- Buyer activity peaks (families want to move before school ends)

- Highest competition among buyers

- Fastest sales and strongest prices

- Multiple offers more common

Best for:

- Sellers who want maximum exposure and competition

- Sellers with family-friendly homes in good school areas

- Buyers who are flexible and prepared to compete

Challenges:

- High competition for buyers

- Need to be ready to move quickly

- Prices at seasonal peak

Summer (June-August): Active but Slowing

What happens:

- Inventory remains strong early summer, then tapers

- Buyer activity gradually slows (families settled, vacation season)

- Sales pace moderates from spring peak

- Pricing remains strong but competition decreases slightly

- Mix of motivated buyers and browsers

Best for:

- Sellers who missed spring window but still want good activity

- Buyers who want less competition than spring but still good selection

- Families who've relocated and need to close before school starts

Challenges:

- Tapering activity as summer progresses

- August can be particularly slow

- Vacation schedules complicate showings and closings

Fall (September-November): Second Active Season

What happens:

- Activity rebounds after summer slowdown (September especially strong)

- Serious buyers and sellers (people who need to move, not just curious)

- Good inventory from sellers who didn't sell in summer

- Less family buyer competition (school already started)

- Reasonable pricing and realistic expectations

Best for:

- Buyers seeking less competition and potentially better negotiating position

- Sellers with non-family homes (condos, smaller properties, retirement homes)

- Anyone who wants serious, motivated counterparties

Challenges:

- Shorter days mean showing schedules compress

- Holiday season approaching creates deadline pressure

- Some buyers exiting market to wait for spring

Winter (December-February): Slowest Season

What happens:

- Lowest inventory (fewest sellers list)

- Fewer active buyers (holidays, weather in other regions, year-end focus)

- Longest time on market

- Most negotiating power for buyers

- Sellers listing are highly motivated (job change, financial need, life event)

Best for:

- Serious buyers seeking least competition and best negotiating position

- Buyers who need to close quickly (motivated sellers)

- Sellers who are relocating or have urgent timeline (will find serious buyers)

Challenges:

- Fewest homes to choose from (buyers)

- Slowest activity and lowest prices (sellers)

- Holiday schedules complicate process

- May need to price more aggressively to generate activity

The Seasonal Strategy

For Sellers:

- If you can choose your timing: List in March-April for maximum exposure

- If you must sell in winter: Price more aggressively to compensate for lower activity

- If you're flexible: List in September for serious buyers with less competition

For Buyers:

- If you want selection: Search in spring/summer when inventory is highest

- If you want negotiating power: Search in late fall/winter when competition is lowest

- If you want balance: Early fall (September) often offers good inventory with moderate competition

The principle: Seasonality doesn't determine whether you should move—it influences how you price and position your move.

Reading Market Signals: Buyer vs. Seller Markets

Understanding market conditions helps you adjust your strategy appropriately.

Seller's Market Characteristics

When you see these signals, sellers have the advantage:

- Inventory is low (fewer than 3 months of supply)

- Homes sell quickly (average days on market under 30)

- Multiple offers are common

- Homes regularly sell at or above asking price

- Price reductions are rare

- New listings receive immediate showing activity

- Buyer competition is high

What this means for sellers:

- Price competitively but not aggressively low

- Expect offers quickly

- Can be selective about terms

- Strong negotiating position

What this means for buyers:

- Must be pre-approved and ready to act quickly

- Expect competition

- Need strong offers (price, terms, or both)

- Less room for extensive negotiations

- Inspection contingencies may need to be shortened

Buyer's Market Characteristics

When you see these signals, buyers have the advantage:

- Inventory is high (more than 6 months of supply)

- Homes sit longer (average days on market over 60)

- Single offers are the norm

- Homes sell below asking price

- Price reductions are common

- Showings trickle in slowly over weeks

- Seller competition is high

What this means for sellers:

- Must price aggressively to generate activity

- May wait weeks for offers

- Need to be flexible on terms

- Weaker negotiating position

- May need to offer credits or concessions

What this means for buyers:

- Can take time to search and evaluate

- Less pressure to compete

- Room to negotiate on price and terms

- Can request repairs or credits

- Stronger negotiating position

Balanced Market Characteristics

When you see these signals, neither side has clear advantage:

- Inventory is moderate (3-6 months of supply)

- Homes sell in reasonable timeframes (30-60 days)

- Mix of single and multiple offer situations

- Homes sell close to asking price

- Occasional price reductions but not widespread

- Steady showing activity

- Moderate competition

What this means for sellers:

- Price accurately based on comps

- Expect reasonable timeframes

- Be prepared to negotiate

- Neither overwhelming advantage nor disadvantage

What this means for buyers:

- Competition exists but isn't extreme

- Time to evaluate but don't over-analyze

- Offers should be fair and competitive

- Some negotiating room exists

BRIDGE: If You're Here Because...

Maybe you're trying to figure out if now is the "right time" to buy or sell. Maybe you're confused because you hear conflicting information from everyone. Maybe you're wondering if you should wait for conditions to improve.

Here's the truth: There's no universally "perfect" market. There are only market conditions you can read and respond to intelligently.

Spring seller's markets are great for sellers but challenging for buyers. Winter buyer's markets are great for buyers but slower for sellers. Balanced markets offer neither side a clear advantage but create fair conditions for both.

The framework we've given you works in ANY market condition. It's about understanding the dynamics so you can make the right decision for YOUR situation—regardless of headlines or predictions.

How Orange County's Unique Factors Affect the Market

Understanding local market characteristics helps you make better decisions.

Geographic Constraints Create Supply Limitations

Orange County is built out:

- Limited available land for new construction

- Ocean on one side, mountains/hills on others

- Existing neighborhoods can't expand

- New supply comes primarily from teardowns/rebuilds

What this means:

- Supply can't dramatically increase to meet demand spikes

- Inherent supply constraint supports long-term pricing

- Inventory fluctuations driven by existing homeowner decisions, not new construction

Diverse Employment Base Creates Stable Demand

Orange County economy:

- Mix of industries (healthcare, technology, tourism, finance, professional services)

- Not dependent on single employer or sector

- Higher-than-average income levels

- White-collar job concentration

What this means:

- Demand remains relatively stable through economic cycles

- Less volatility than single-industry markets

- Strong buyer pool across price ranges

Lifestyle Desirability Attracts External Demand

Quality of life factors:

- Year-round temperate climate

- Beach proximity

- Strong school districts

- Low crime rates

- Cultural amenities and dining

What this means:

- Buyers from other regions willing to pay premium

- Transplant demand supplements local demand

- "Livability" supports long-term pricing power

Neighborhood Micro-Markets Vary Significantly

Orange County isn't one market—it's dozens:

- Cypress dynamics differ from Seal Beach differ from Anaheim differ from Buena Park

- School boundaries create value variation street by street

- Neighborhood character and amenities affect pricing

- Age and condition of housing stock varies widely

What this means:

- You must understand your specific micro-market, not just "Orange County"

- Pricing and activity levels vary dramatically by location

- A seller's market in one neighborhood can coexist with balanced conditions in another

Decision Framework: Should You Move Forward or Wait?

Use this framework to evaluate whether to act now or pause:

Move Forward Now If:

For Sellers:

- You have a legitimate life reason to move (not just "testing the market")

- Your home is ready to compete (condition, preparation, positioning)

- Current conditions are reasonable (not a severe buyer's market)

- You can afford to price accurately based on comps

- You have a plan for where you'll go next

For Buyers:

- You have strong financing and down payment ready

- You plan to stay 5+ years

- You've found homes in your price range that meet your needs

- You can afford to compete in current conditions

- You're emotionally and financially prepared

If most boxes are checked, market conditions shouldn't stop you from moving forward.

Consider Waiting If:

For Sellers:

- You're just curious about value but don't need to move

- Your home needs preparation you're not ready to do

- You're hoping for a price significantly above comps

- You have no plan for your next move

- Current conditions are severely unfavorable and you can wait

For Buyers:

- You're not financially ready (down payment, emergency fund, stable income)

- You might relocate within 3-5 years

- You're waiting for "perfect" conditions (which don't exist)

- You're hoping to time the market perfectly (impossible)

- You're not emotionally ready for homeownership responsibility

If several boxes are checked, waiting might be appropriate—but create a specific plan for when you'll be ready.

Never Wait For:

These are traps that keep people on the sidelines indefinitely:

- "The perfect market" (doesn't exist—every market has tradeoffs)

- "Prices to drop significantly" (unpredictable and may never happen)

- "The absolute bottom" or "absolute peak" (impossible to time)

- "When everything aligns perfectly" (something is always imperfect)

- "When I have zero doubt" (major decisions always involve some uncertainty)

The insight: Waiting for perfect conditions means waiting forever. Understand current conditions, make informed decisions, and execute when your personal situation aligns with reasonable market dynamics.

Self-Assessment: Do You Understand Your Market?

Answer honestly:

MARKET FUNDAMENTALS:

- I understand how supply and demand drive pricing

- I know why some homes sell fast and others sit

- I recognize seasonal patterns and how they affect activity

- I can identify whether current conditions favor buyers or sellers

- I know what actually drives pricing (vs. myths)

LOCAL KNOWLEDGE:

- I understand my specific neighborhood's characteristics

- I know how my area differs from broader Orange County trends

- I've researched comparable sales in my target area

- I know which factors affect value in my specific location

- I understand the buyer pool for my price range

DECISION CLARITY:

- I know whether to move forward now or wait

- My decision is based on my situation, not fear or FOMO

- I have realistic expectations for current conditions

- I understand the tradeoffs of acting now vs. waiting

- I have a clear strategy aligned with market realities

If you checked 12+ boxes: You have a solid understanding of how markets work.

If you checked 8-11 boxes: You understand the basics but would benefit from local expertise.

If you checked fewer than 8 boxes: Partner with an experienced agent who can help you read the market.

What to Do This Week

Based on your situation:

IF YOU'RE PREPARING TO SELL:

- Analyze recent comparable sales in your specific neighborhood

- Assess current inventory (how many competing homes are available?)

- Identify market signals (is this a seller, buyer, or balanced market?)

- Evaluate seasonality (is now optimal timing or should you wait for spring?)

- Get expert input on your home's competitive position

IF YOU'RE PREPARING TO BUY:

- Research your target neighborhoods (are they in high demand? Limited inventory?)

- Track how fast homes sell (days on market trends)

- Monitor new listings (is inventory increasing or decreasing?)

- Identify market conditions (will you face heavy competition?)

- Adjust your strategy based on whether conditions favor buyers or sellers

IF YOU'RE TRYING TO DECIDE WHETHER TO MOVE FORWARD:

- Review the decision framework above honestly

- Separate your situation from market conditions

- Assess whether waiting would actually improve your position

- Create a specific timeline if you decide to wait (not indefinite "someday")

- Get professional guidance to evaluate your specific situation

Let's Help You Understand Your Specific Market

Here's the reality: Understanding broad market principles is valuable, but what really matters is how these dynamics are playing out in YOUR specific neighborhood and price range RIGHT NOW.

Cypress market conditions differ from Los Alamitos differ from Buena Park differ from Anaheim. And within each area, micro-markets vary by school boundaries, neighborhood character, and property type.

If you're considering buying or selling in Cypress, Anaheim, Buena Park, La Palma, or anywhere in Orange County, we can help you understand your specific market conditions.

On a market consultation, we'll:

- Analyze current supply and demand in your specific area and price range

- Review recent comparable sales and active competition

- Identify market signals (buyer, seller, or balanced conditions)

- Discuss seasonal timing and whether now or later makes sense for you

- Explain local factors specific to your neighborhood

- Help you develop a strategy aligned with current market realities

No pressure. No sales pitch. Just local expertise to help you understand what's actually happening in YOUR market.

We've been tracking Cypress and Orange County market dynamics for nearly 30 years. We know how these principles play out in real neighborhoods with real buyers and sellers. And we'll give you the straight story about what you're facing.

READY TO UNDERSTAND YOUR SPECIFIC MARKET?

What happens on the call:

- 30-45 minutes focused on your specific area and situation

- Current market data for your neighborhood and price range

- Comparable sales analysis and competition assessment

- Honest evaluation of whether conditions favor your goals

- Strategic recommendations for timing and positioning

No obligation. No pressure. Just local market intelligence you can't get from national websites or headlines.

Our family has been helping Cypress and Orange County families understand their market since 1996. We'll give you the clarity you need to make confident decisions.

Our family helping yours, since 1996.