Conversion in progress ...

Please wait while we generate your PDF

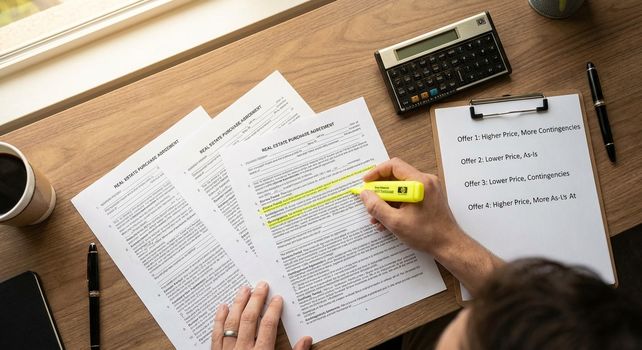

The Offer Truth Playbook (Terms > Price)

QUICK SUMMARY

What you'll learn in 5 minutes:

- Why the highest offer isn't always the best offer (and how to tell the difference)

- How to decode offer terms and identify red flags that predict deal failure

- What contingencies actually mean and which ones protect you vs. expose you to risk

- How to evaluate financing strength (the #1 predictor of whether a deal will close)

- The hidden value of timeline flexibility, appraisal gap coverage, and repair approaches

- How to handle multiple offers strategically (it's not just about picking the highest number)

- A scoring framework to compare offers objectively across all dimensions

The Highest Number Isn't Always the Best Deal

You've listed your Cypress or Orange County home. Offers start coming in. One buyer offers $50,000 more than the others. Exciting, right?

Maybe. Or maybe that high offer is built on shaky financing, riddled with contingencies that give them multiple exit ramps, and comes from a buyer who's going to nickel-and-dime you on every inspection item.

Meanwhile, the second-highest offer has rock-solid financing, minimal contingencies, matches your preferred timeline, and comes from a buyer who pre-committed to being reasonable on repairs.

Which offer should you accept?

Here's what we've learned after helping hundreds of sellers navigate offer decisions in Orange County: The offer that closes smoothly at a fair price beats the highest offer that falls apart after 30 days in escrow—every single time.

This guide teaches you how to evaluate offers beyond just the price. You'll learn to identify strong buyers, spot red flags, understand what terms actually matter, and choose the offer that gives you the most certainty with the least stress.

This is for you if:

- You're preparing to list and want to know how to evaluate offers intelligently

- You've received multiple offers and need to decide which to accept

- You want to understand what separates a strong offer from a weak one

- You're trying to avoid the nightmare of a deal falling apart mid-escrow

- You're ready to make strategic decisions instead of emotional ones

START HERE (30 SECONDS)

Find your situation below and jump to the section that matters most:

- "I have multiple offers and don't know how to choose" → Jump to "The Multiple Offer Evaluation Framework"

- "I want to understand what makes an offer strong or weak" → Go to "Decoding Offer Strength: The Key Components"

- "I'm confused about contingencies and what they mean" → Read "Understanding Contingencies: Your Protection vs. Your Risk"

- "I need to know if a buyer's financing is solid" → Start with "Evaluating Financing Strength"

- "I want the complete offer evaluation system" → Read straight through

What Most Sellers Get Wrong About Offers

Here's the pattern we see repeatedly:

A seller receives offers. They scan for the price. They see one that's $30,000-$50,000 higher than the others. They get excited and accept it without reading the fine print.

Then reality unfolds:

Week 1: Buyer's lender requests additional documentation. Delays start.

Week 2: Appraisal comes in $20,000 below offer price. Buyer has no appraisal gap coverage. Renegotiation begins.

Week 3: Inspection reveals minor issues. Buyer requests $15,000 in repairs or credits. Negotiations drag on.

Week 4: Buyer's lender raises concerns about debt-to-income ratio. Financing contingency still in place.

Week 5: Deal falls apart. You're back on market as a "failed sale." Stigma attached. Other buyers have moved on.

You wasted 5 weeks and now you're starting over—likely accepting less than you could have gotten from the second offer.

The mistake: Choosing price over terms, and paying for it with time, stress, and ultimately money.

Decoding Offer Strength: The Key Components

Every offer has multiple dimensions. Here's what actually matters:

Component #1: Purchase Price

What it is: The dollar amount the buyer is offering to pay

Why it matters: Obviously affects your proceeds

But remember:

- Highest price means nothing if the deal doesn't close

- Price is negotiable if appraisal comes in low

- Other terms can be worth $10,000-$30,000 in real value

How to evaluate:

- Compare to your list price and recent comparable sales

- Consider in context with other offer terms

- Recognize that price alone doesn't determine your net proceeds

Component #2: Financing Type and Strength

This is the #1 predictor of whether a deal will close.

Financing types ranked by strength:

1. All Cash (Strongest)

- No lender, no appraisal requirement, no loan contingency

- Can close in 7-14 days typically

- Highest certainty of closing

- Buyer must provide proof of funds

2. Conventional Loan with 20%+ Down (Very Strong)

- No PMI, easier underwriting

- Strong buyer financial position

- Appraisal required but buyer has capacity to cover gap

- Standard 30-45 day timeline

3. Conventional Loan with 10-19% Down (Moderate)

- PMI required but otherwise standard

- Buyer may have limited cash for appraisal gap

- Normal underwriting process

- Watch debt-to-income ratio

4. FHA/VA Loans (Requires More Scrutiny)

- Government-backed, more stringent property requirements

- Appraisal includes condition/safety items, not just value

- May require repairs you wouldn't otherwise do

- Longer timeline (45-60 days typical)

- Down payment as low as 0-3.5%

5. Non-QM or Alternative Financing (Highest Risk)

- Non-traditional lenders

- Higher interest rates

- More complicated underwriting

- Higher likelihood of issues

Red flags in ANY financing:

- Unknown or online-only lender

- Pre-qualification letter (not pre-approval)

- Minimal down payment relative to loan amount

- Buyer at absolute maximum debt-to-income ratio

- Generic pre-approval not specific to this property/price

Component #3: Down Payment Percentage

Why it matters:

- Shows buyer's financial strength

- Indicates skin in the game

- Affects appraisal gap risk

- Signals likelihood of loan approval

Down payment tiers:

20%+ down:

- Strong financial position

- Can likely cover appraisal gap

- Lower loan-to-value = easier approval

- Motivated to close (significant earnest deposit typically)

10-19% down:

- Moderate financial position

- Limited ability to cover large appraisal gap

- Still viable but less cushion

5-9% down:

- Thin margins

- Minimal ability to adjust if appraisal is low

- Watch for other red flags

Under 5% down (FHA 3.5% or conventional 3-5%):

- Buyer has minimal reserves

- Very limited ability to handle surprises

- Appraisal gap coverage unlikely

- Higher risk of financing falling through

The insight: Higher down payment = more financial stability = higher probability of closing.

Component #4: Earnest Money Deposit

What it is: The "good faith" deposit showing buyer is serious

Standard: 1-2% of purchase price

Strong: 2-3% of purchase price

Why it matters:

- Shows financial capability

- Creates incentive to close (buyer wants it back)

- Larger deposit = more serious buyer

Red flags:

- Deposit under 1%

- Delayed deposit (beyond 3 days)

- Requests to reduce deposit during negotiations

Component #5: Contingencies

These are the buyer's legal exit ramps. We'll cover these in detail below.

The general principle:

- More contingencies = more risk for you

- Longer contingency periods = more uncertainty

- Stronger buyers can shorten or limit contingencies

Component #6: Timeline

Closing date:

- Does it match your needs?

- Is buyer flexible if your timeline changes?

- Can buyer actually perform that quickly (if fast close)?

Contingency removal timeline:

- Standard: 17-21 days

- Strong: 7-10 days

- Red flag: 30+ days

Rent-back:

- Buyer offers you time to stay after closing

- Can be worth $3,000-$8,000 in value to you

- Free rent-back is a significant concession

Component #7: Repair Approach

How buyer signals their repair expectations:

Strongest (for you):

- "Buyer will only request repairs for major system failures or health/safety issues exceeding $X threshold"

- "Property accepted in current condition with normal wear and tear expected"

- Pre-commits to limiting repair requests

Moderate:

- Standard inspection contingency with no pre-commitment

- Will request repairs based on inspection findings

- Typical negotiation expected

Weakest (for you):

- Open-ended repair requests

- Buyer hasn't toured property thoroughly (may be shocked by condition)

- History of extensive repair demands (if you can discover this)

Component #8: Appraisal Gap Coverage

What it is: Buyer's commitment to cover the difference if appraisal comes in below offer price

Strong offers include:

- "Buyer will cover appraisal gap up to $20,000-$30,000"

- Shows financial capacity and commitment

- Reduces your risk of renegotiation

Moderate:

- "Buyer will cover appraisal gap up to $10,000-$15,000"

- Some protection but limited

Weak:

- No appraisal gap coverage mentioned

- Buyer can renegotiate or walk if appraisal is low

- Common with buyers who put minimal down payment

The reality: Appraisal gap coverage is worth more than its dollar amount—it's insurance against renegotiation.

Understanding Contingencies: Your Protection vs. Your Risk

Contingencies are conditions that must be met for the sale to proceed. They give buyers legal exit ramps.

The Main Contingencies in California

1. Loan/Financing Contingency

What it means: Buyer can cancel if they can't get financing approved

Standard timeline: 21 days

Your risk:

- Buyer's lender may deny loan after weeks in escrow

- Buyer can use this to renegotiate if appraisal is low

- Deal can fall apart late in process

How to evaluate:

- Shorter period (17 days) is better for you

- Strong pre-approval reduces risk

- Cash offers eliminate this entirely

Red flag: Financing contingency longer than 21 days suggests buyer isn't confident in approval

2. Appraisal Contingency

What it means: Buyer can cancel if appraisal comes in below offer price

Standard timeline: 17 days (tied to loan contingency)

Your risk:

- If appraisal is low, buyer can demand price reduction

- Or buyer can walk away and get deposit back

- You've wasted 2-3 weeks and may need to reduce price

How to mitigate:

- Appraisal gap coverage (buyer agrees to cover X amount if appraisal is low)

- Strong comparable sales support your price

- Cash buyers sometimes waive appraisal contingency entirely

Red flag: Buyer with minimal down payment and no appraisal gap coverage is high risk for renegotiation

3. Inspection Contingency

What it means: Buyer can inspect property and request repairs, credits, or cancel

Standard timeline: 17 days

Your risk:

- Buyer can request extensive repairs

- Or use inspection to renegotiate price

- Or cancel if they get cold feet (inspection is common excuse)

How to evaluate:

- Shorter period (7-10 days) shows commitment

- Pre-commitment to limit repair requests is valuable

- Buyer who's thoroughly toured property is less likely to be surprised

Your protection:

- You don't have to agree to repair requests

- But buyer can cancel if you don't

Strategic consideration: Inspection contingency protects buyers from surprises, which ultimately protects you from lawsuits. Don't celebrate buyers waiving this unless they're experienced investors.

4. Sale of Buyer's Property Contingency

What it means: Buyer can't close until they sell their current home

Your risk:

- You're at mercy of buyer's home selling

- Could take weeks or months

- Buyer's sale could fall through

- You're essentially off market while waiting

How to evaluate:

- Is buyer's home already in escrow? (Better)

- Is it just listed? (Risky)

- Not listed yet? (Very risky—you're basically taking your home off market with no certainty)

Red flag: This contingency without buyer's home already sold or in escrow is extremely risky

Counter-strategy: Negotiate a "kick-out clause" (you can accept backup offers and give this buyer 72 hours to remove contingency or walk)

5. Review of HOA Documents (If Applicable)

What it means: Buyer can review HOA rules, budgets, meeting minutes, etc. and cancel if unsatisfied

Standard timeline: 3-7 days

Your risk:

- Buyer may find something objectionable in HOA rules

- HOA financial problems could surface

- Special assessments could be revealed

How to evaluate:

- Very standard contingency, not usually a red flag

- Shorter period is better

Contingency Removal: The Critical Deadline

When buyer "removes contingencies," they're giving up their right to cancel without penalty.

Before contingency removal:

- Buyer can cancel for any reason related to contingencies

- Gets earnest deposit back

- No penalty

After contingency removal:

- Buyer is committed to closing

- Can only cancel for reasons outside contingencies

- Risks losing earnest deposit if they back out

Why this matters to you:

- Strong buyers remove contingencies quickly (7-14 days)

- Weak buyers drag out contingencies (21+ days)

- Once removed, you have much more certainty

The strategic insight: An offer with slightly lower price but faster contingency removal may be better than higher price with extended contingencies.

Evaluating Financing Strength: The Details Matter

The pre-approval letter is your window into buyer's financial position. Here's how to read it:

Strong Pre-Approval Signals

Lender:

- Local, reputable lender you or your agent recognize

- Direct lender, not broker aggregating to unknown sources

- Established track record

Letter specifics:

- Addressed specifically to your property/price

- Recent date (within 30 days)

- States "pre-approved" not "pre-qualified"

- Includes specific loan amount and down payment

- Signed by actual loan officer with contact info

Buyer financial profile (if disclosed):

- Down payment well above minimum

- Debt-to-income ratio comfortably below maximum

- Strong credit score (750+)

- Stable employment (2+ years)

Weak Pre-Approval Red Flags

Lender:

- Unknown online-only lender

- Broker without clear funding source

- Lender with poor reputation

Letter issues:

- Generic letter not specific to your property

- Old date (60+ days)

- Says "pre-qualified" (much weaker than pre-approved)

- Vague language about loan amount

- No loan officer signature or contact info

- Conditional language ("subject to..." or "pending...")

Buyer financial concerns:

- Minimal down payment

- Maxed out at absolute highest loan amount

- Recent job change

- Self-employed without strong documentation history

If you see multiple red flags, this buyer has high risk of financing falling through.

Questions to Ask Your Agent About Financing

For any offer, have your agent verify:

- Is this lender reputable? (Your agent should know local lenders)

- Is the buyer pre-approved or pre-qualified? (Huge difference)

- What's the down payment percentage? (Higher is better)

- Has the buyer been pre-underwritten? (Extra level of approval)

- What's the loan type and any special requirements? (FHA/VA have property requirements)

- Can the lender close in the proposed timeline? (Some can't perform as fast as they claim)

Your agent should be able to call the lender and verify these details.

The Multiple Offer Evaluation Framework

You have 3-5 offers on your home. Here's how to evaluate them systematically instead of emotionally.

Step 1: Create an Offer Comparison Scorecard

Score each offer on these dimensions (1-10 scale):

| Criteria | Weight | Offer A | Offer B | Offer C |

|---|---|---|---|---|

| Price | 30% | |||

| Financing Strength | 25% | |||

| Down Payment % | 15% | |||

| Contingency Terms | 10% | |||

| Timeline Fit | 10% | |||

| Repair Approach | 5% | |||

| Appraisal Gap Coverage | 5% | |||

| TOTAL SCORE | 100% |

How to score each dimension:

Price (30% weight):

- 10 = Highest offer

- 8-9 = Within 2-3% of highest

- 6-7 = Within 5% of highest

- 4-5 = More than 5% below highest

- 1-3 = Significantly below

Financing Strength (25% weight):

- 10 = All cash with proof of funds

- 8-9 = Conventional with 20%+ down, reputable lender

- 6-7 = Conventional with 10-19% down

- 4-5 = FHA/VA with strong approval

- 1-3 = Weak financing or red flags

Down Payment % (15% weight):

- 10 = 25%+ down or all cash

- 8-9 = 20% down

- 6-7 = 10-15% down

- 4-5 = 5-9% down

- 1-3 = Under 5% down

Contingency Terms (10% weight):

- 10 = Minimal contingencies, short timelines (7-10 days)

- 8-9 = Standard contingencies, reasonable timelines (17 days)

- 6-7 = Standard contingencies, longer timelines (21+ days)

- 4-5 = Extra contingencies or very long timelines

- 1-3 = Sale contingency or multiple red flags

Timeline Fit (10% weight):

- 10 = Perfect match to your needs + flexibility

- 8-9 = Matches your needs

- 6-7 = Workable but not ideal

- 4-5 = Requires you to adjust significantly

- 1-3 = Doesn't work for your timeline

Repair Approach (5% weight):

- 10 = Pre-committed to limiting requests, as-is language

- 8-9 = Reasonable approach indicated

- 6-7 = Standard inspection contingency

- 4-5 = Signals for extensive requests

- 1-3 = Red flags about pickiness

Appraisal Gap Coverage (5% weight):

- 10 = Will cover $25,000+ gap

- 8-9 = Will cover $15,000-$24,000 gap

- 6-7 = Will cover $5,000-$14,000 gap

- 4-5 = Will cover up to $5,000

- 1-3 = No coverage mentioned

Step 2: Calculate Weighted Scores

Multiply each score by its weight, then total.

Example:

Offer A:

- Price: 10 × 30% = 3.0

- Financing: 6 × 25% = 1.5

- Down Payment: 5 × 15% = 0.75

- Contingencies: 7 × 10% = 0.7

- Timeline: 8 × 10% = 0.8

- Repairs: 6 × 5% = 0.3

- Appraisal Gap: 3 × 5% = 0.15

- Total: 7.2

Offer B:

- Price: 8 × 30% = 2.4

- Financing: 9 × 25% = 2.25

- Down Payment: 9 × 15% = 1.35

- Contingencies: 9 × 10% = 0.9

- Timeline: 10 × 10% = 1.0

- Repairs: 9 × 5% = 0.45

- Appraisal Gap: 8 × 5% = 0.4

- Total: 8.75

Offer C:

- Price: 9 × 30% = 2.7

- Financing: 10 × 25% = 2.5

- Down Payment: 10 × 15% = 1.5

- Contingencies: 8 × 10% = 0.8

- Timeline: 7 × 10% = 0.7

- Repairs: 8 × 5% = 0.4

- Appraisal Gap: 10 × 5% = 0.5

- Total: 9.1

Result: Offer C scores highest despite not being the highest price (Offer A).

Step 3: Consider Qualitative Factors

Beyond the scorecard, ask:

- Do any offers come with personal letters that resonate?

- Does your agent have experience with any of these buyers' agents?

- Are any buyers local vs. relocating?

- Do any offers feel like they'll create unnecessary stress?

These don't override the scorecard, but they can be tie-breakers.

Step 4: Counter Strategically

If you have multiple strong offers:

Option A: Counter all of them

- Send same counter-offer to top 2-3 offers

- Ask for improved terms (price, timeline, contingencies, etc.)

- Create competition

- First to accept wins

Option B: Focus on strongest 1-2

- Counter only the top offers

- Negotiate privately

- Less pressure but potentially leaves money on table

Option C: Best and Final

- Tell all buyers you're requesting best and final offers by deadline

- Ask them to submit their absolute best terms

- Review and choose

- Clean but can feel aggressive

Your agent will guide you on which approach fits your situation.

BRIDGE: If You're Here Because...

Maybe you're about to list and want to understand how you'll evaluate offers when they come in. Maybe you've received offers already and you're overwhelmed trying to compare them. Maybe you accepted what looked like a great offer and it's falling apart, and you're trying to understand what you missed.

Here's the truth: Offer evaluation is part art, part science. The science is in understanding the components systematically. The art is in reading the signals and trusting your gut when something feels off.

The framework we've given you works for any property, any price point, and any market condition. It's about separating emotion from strategy so you choose the offer that will actually close with minimal stress.

Special Situations and Strategic Considerations

Situation #1: One Offer Far Higher Than Market Value

The tempting scenario:

- Comps suggest your home is worth $700,000

- You receive an offer for $750,000

- It seems too good to be true

Why this happens:

- Buyer emotionally attached and not strategic

- Buyer hasn't researched comps

- Buyer desperate due to life circumstances

- Foreign buyer unfamiliar with market

The risk:

- Very likely won't appraise

- Unless buyer has appraisal gap coverage, you'll renegotiate down

- You'll waste 2-3 weeks

What to do:

- Accept it, but only if buyer has strong appraisal gap coverage

- Be prepared for renegotiation

- Have backup plan

- Don't turn down other offers until this one clears appraisal

Situation #2: All-Cash Offer Below Asking

The scenario:

- You're listed at $700,000

- Cash buyer offers $675,000

- No financing, quick close

Why this happens:

- Cash buyers know they bring value (certainty)

- They try to negotiate discount for that certainty

- Often investors or very experienced buyers

What to consider:

- Is $25,000 worth the certainty and speed?

- Could financed offers fall apart and leave you accepting less anyway?

- What's your risk tolerance and timeline need?

What to do:

- Counter at price you'd accept for certainty

- If no other offers, seriously consider it

- If you have stronger financed offers, compare using scorecard

Situation #3: Offer with Sale Contingency

The scenario:

- Buyer must sell their home first

- Offers good price but you're tied up waiting

What to negotiate:

- Kick-out clause (you can accept backup offers; give them 72 hours to remove contingency)

- Require their home be in escrow already (not just listed)

- Get proof of their home's pending sale status

- Short timeline for them to remove contingency

When to accept:

- Slow market with few offers

- Their home is already sold or close to closing

- You have time and aren't in rush

When to decline:

- Active market with other offers

- Their home isn't sold yet

- You need certainty

Situation #4: Backup Offers

What they are: Offers submitted after you've accepted another offer, positioned as "backup" in case first deal fails

Why to consider them:

- Insurance policy if your accepted offer falls through

- Leverage if you need to renegotiate with first buyer

- Keeps interested buyers engaged

How to handle:

- Can accept backup offers in position (First backup, second backup, etc.)

- They wait until first deal closes or fails

- You're not obligated to them if first deal closes

Red Flags That Predict Deal Failure

Watch for these warning signs in any offer:

Financing Red Flags

- Pre-qualified instead of pre-approved

- Unknown or online-only lender

- Minimal down payment (under 5%)

- Buyer at absolute maximum loan amount

- Recent job change or income uncertainty

- Self-employed without strong documentation

Behavioral Red Flags

- Buyer makes offer without touring property

- Excessive questions or demands before offer accepted

- Changes in offer terms between verbal and written

- Lack of responsiveness from buyer or agent

- Multiple previous contracts that fell through (if you can discover this)

Timeline Red Flags

- Requests very long contingency periods (30+ days)

- Can't move quickly on inspections

- Vague about closing date needs

- Asks for excessive extensions

Agent Red Flags

- Buyer's agent is new or inexperienced

- Agent doesn't return calls promptly

- Agent makes unrealistic claims

- Agent doesn't know how to complete paperwork properly

If you see 3+ red flags, seriously consider passing on this offer even if price is attractive.

Self-Assessment: Can You Evaluate Offers Strategically?

Answer honestly:

OFFER COMPONENT UNDERSTANDING:

- I understand why financing strength matters more than price alone

- I know how to evaluate down payment percentages

- I understand what each contingency means and the risk it creates

- I can identify strong vs. weak pre-approval letters

- I know what appraisal gap coverage is and why it matters

EVALUATION CAPABILITY:

- I can compare multiple offers across all dimensions

- I know how to weight different factors appropriately

- I can spot red flags that predict deal failure

- I understand when to counter vs. accept vs. decline

- I have a framework for making the decision, not just gut feel

STRATEGIC THINKING:

- I know my priorities (speed vs. price vs. certainty vs. convenience)

- I understand the tradeoffs between different offer types

- I can resist the temptation of highest price if terms are weak

- I'm prepared to walk away from risky offers

- I have trusted advisors (agent, attorney) to consult

If you checked 12+ boxes: You're well-prepared to evaluate offers strategically.

If you checked 8-11 boxes: You understand the basics but need expert guidance.

If you checked fewer than 8 boxes: Partner closely with an experienced agent—offer evaluation is too critical to wing it.

What to Do This Week

Based on where you are:

IF YOU'RE PREPARING TO LIST:

- Review this framework so you're prepared when offers come

- Discuss with your agent how you'll handle multiple offers

- Clarify your priorities (price vs. timeline vs. certainty)

- Understand your agent's vetting process for buyer financing

- Decide your minimum acceptable terms before emotions are involved

IF YOU HAVE OFFERS ON THE TABLE:

- Create the comparison scorecard for each offer

- Have your agent verify financing with each lender

- Identify red flags in any offers

- Calculate weighted scores across all dimensions

- Discuss counter-offer strategy with your agent before responding

IF YOU'RE IN ESCROW AND CONCERNED:

- Review the buyer's performance so far (meeting deadlines?)

- Check on financing progress (lender updates?)

- Identify any red flags that have emerged

- Discuss backup plan with your agent if this falls through

- Don't make major plans until contingencies are removed

Let's Help You Navigate Your Offer Decisions

Here's the reality: Evaluating offers looks simple on the surface (just pick the highest number), but it requires understanding financing, contingencies, buyer psychology, and risk assessment.

The sellers who make the best decisions are the ones who work with experienced agents who can decode offer strength, verify buyer qualifications, and advise on strategic negotiations.

If you're selling in Cypress, Anaheim, Buena Park, La Palma, or anywhere in Orange County, we can guide you through every offer decision.

On a listing consultation, we'll:

- Explain our offer evaluation process in detail

- Show you examples of strong vs. weak offers we've handled

- Discuss how we vet buyer financing before you accept

- Create your personalized priorities (what matters most to you)

- Develop a multiple offer strategy if we expect competition

- Be available to advise when offers come in (often evenings/weekends)

No pressure. No obligation. Just expert guidance to help you choose the right buyer—not just the highest bidder.

We've evaluated hundreds of offers for sellers in Orange County. We know how to read between the lines, spot red flags before they become problems, and position you to close smoothly at the best possible terms.

READY TO SELL STRATEGICALLY?

What happens on the call:

- 30-45 minutes focused on your selling goals and concerns

- Detailed walkthrough of our offer evaluation and vetting process

- Example scenarios from past transactions (what worked, what didn't)

- Your customized strategy based on your home and priorities

- Clear plan for handling offers when they arrive

No sales pitch. No pressure. Just the strategic guidance you need to make the best decision when offers come in.

Our family has been helping Orange County sellers navigate offer decisions since 1996. We'll give you the same careful analysis and honest advice we'd want for our own family.

Our family helping yours, since 1996.